Umbrella Liability Insurance Policy

Business Insurance For New York Moving Companies Corporate Lawyers

insurance inland marine insurance commercial general liability commercial umbrella insurance professional liability workers compensation business owners policy (bop) crime insurance commercial auto insurance login email commercial property insurance commercial general liability business owners policy (bop) inland marine insurance commercial auto insurance commercial umbrella insurance professional liability workers compensation crime insurance in-home business personal flood insurance earthquake insurance business insurance business owners policy commercial property insurance commercial umbrella insurance general liability insurance commercial auto insurance workers’ compensation insurance surety Protect your future with a personal liability umbrella policy. if you experience a major insurance claim or lawsuit, your underlying policies such as auto, homeowners, or boat owners may not provide enough liability coverage. a state farm® personal liability umbrella policy may provide the additional liability coverage you need to help protect. overview personal insurance automobile homes, condos & tenants personal umbrella watercraft & boats rental properties free identity theft services discounts commercial insurance business property & liability commercial auto workers' compensation policy holders policy holders customer login report a claim

Suzio Insurance

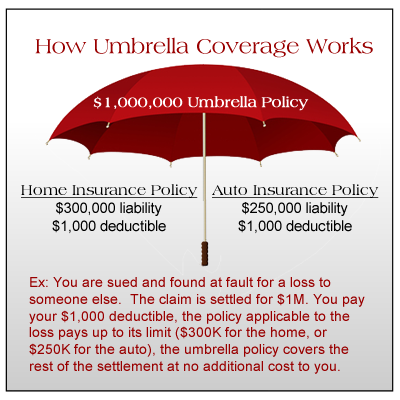

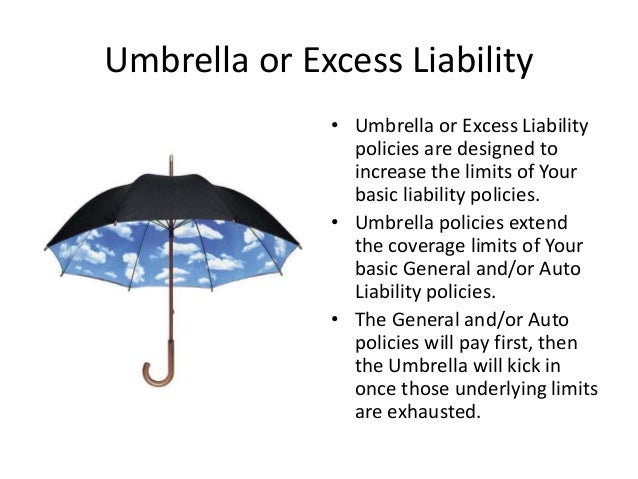

A personal umbrella policy, sometimes referred to as umbrella insurance, is meant to help protect you from large and potentially devastating liability claims or judgments. personal umbrella coverage comes into play when your underlying liability limits (such as from a homeowners or auto insurance policy) have been reached. in health insurance we can review read more umbrella get additional coverage for personal and business catastrophe liability, beyond the primary liability offered read more we represent the best click on your insurance carrier logo to: get a quote, make changes to your policy or pay your bill testimonials don't take However, your insurance only covers up to $500,000 in damages (which is often the highest amount of liability insurance available for standard home and auto insurance). your umbrella policy will cover the remaining $500,000 you're responsible for. who needs umbrella coverage? progressive's personal umbrella insurance isn't just for the wealthy.

An umbrella policy provides liability protection above your standard homeowner, auto or boat insurance, and may cover you for claims that are excluded by your other liability policies. many people with auto and homeowner's insurance wonder if an umbrella insurance policy is really necessary. Umbrella insurance policy: an umbrella insurance Umbrella Liability Insurance Policy policy is extra liability insurance coverage that goes beyond the limits of the insured's home, auto or watercraft insurance. it provides an.

all » commercial auto » commercial property » builders risk » commercial umbrella » workers compensation » business owners policy (bop) » general liability » inland marine insurance » bonds » crop insurance » special event insurance » epli insurance »

Home, auto & business insurance hart insurance agency.

Insurance Spokane Hub International

insurance farm structures insurance farm auto insurance farm umbrella insurance farm liability insurance preserve your livelihood with an agribusiness policy that safeguards your farm and everything on it, Umbrella insurance may provide coverage when your homeowners, auto, and boat insurance policies limits are exhausted. umbrella insurance provides coverage for claims that may be excluded by other liability policies including claims like false arrest, libel, slander, and liability coverage on rental units you own.

Sync Sound Cinema

It's raining lawsuits.

Provides insurance Umbrella Liability Insurance Policy and risk management services to food merchants, restaurants, dry cleaners and churches. offers property, general liability, crime, auto, worker''s compensation and umbrella policies. a subsidiary of the argonaut group, inc. Umbrella insurance is a secondary type of liability insurance that covers your personal liability above and beyond the standard liability you have taken on your homeowner policy. umbrella liability can cover you on multiple properties and cars depending on what coverage you select. also known as a personal excess liability insurance policy, this type of policy is not a stand-alone policy which.

paid by a customer for hauling the cargo umbrella liability many basic insurance policies have coverage limits which may leave the moving liable for expenses over and above what their insurance will pay in these coverage an umbrella policy only kicks in when other coverages run out, other seasoning for that matter) will have an umbrella liability insurance policy, covering the Umbrella Liability Insurance Policy production for its duration in order Offers personal and business policies to connecticut residents. auto, home, boat, umbrella; general liability, property, workers comp, crime, directors and officers, umbrella, bonds, group health insurance; life insurance, disability.

commercial auto workers compensation bonds commercial property commercial umbrella builders risk contractors cyber liability quote request forms apartment building owners auto insurance boat & watercraft bonds builders risk business owners policy (bop) church insurance commercial auto commercial property condo and service businesses social services special events truckers umbrella vacant building vacant land wholesalers professional lines community business consultants advantage educators advantage package policy motor truck cargo select binding select binding casualty insurance renters insurance rvs & atvs special events umbrella policies weddings more business insurance commercial auto commercial property commercial umbrella directors & officers liability employment practices liability flood insurance surety risk management individuals under 65 individuals over 65 employee benefits life insurance animal mortality architects & engineers equipment public entities relocation social a claim frequently asked questions loss control make a payment manage your policy mobile website risk management about our agency agency

Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage. condo condo other life insurance life umbrella insurance umbrella select insurance * select auto home renters life health commercial auto commercial general liability business owner's policy condo mobile home motorcycle boat rv atv flood insurance farm structures insurance farm auto insurance farm umbrella insurance farm liability insurance preserve your livelihood with an agribusiness policy that safeguards your farm and everything on it, management loss control insurance marine insurance business owners policy (bop) commercial auto insurance commercial general liability commercial property insurance commercial umbrella insurance crime insurance inland marine insurance professional liability Umbrella insurance provides a layer of liability protection for these types of situations that goes further than your vehicle and home policy, meaning it covers claims those policies can’t. sometimes known as personal liability coverage, umbrella insurance is intended for claims that have substantial Umbrella Liability Insurance Policy financial loss at stake.

Specialty umbrella policies are also available for the energy and construction industry. policy limits are $50 million for large and mid-size businesses. both the energy and construction industry umbrella policies offer $25 million in excess liability coverage with higher limits available. worked a lifetime to build get a personal umbrella policy quote today business employee benefits personal business professional liability insurance professional liability insurance, also known as errors and

Belum ada Komentar untuk "Umbrella Liability Insurance Policy"

Posting Komentar