Forex Psychology Trading

Loss psychology refers to the emotional side of investing, namely the negative sentiment associated with recognizing a loss and its psychological effects. more trading psychology definition. The psychology of forex tradingtradingpsychology is a critical aspect of achieving success in the forex market. it deals with the emotional condition of a trader when entering and exiting trades, looking for potential trade opportunities, or carrying out other trading-related tasks. The psychology of forex trading trading psychology is a critical aspect of achieving forex psychology trading success in the forex market. it deals with the emotional condition of a trader when entering and exiting trades, looking for potential trade opportunities, or carrying out other trading-related tasks.

Any forex trader with even the smallest amount of trading experience will understand how much of a crucial role trading psychology plays in your trading success. forex trading is one of the toughest, if not the toughest mental challenge you will ever face in life. A large part of successful trading comes from mastering your mind and your thoughts. sadly, many traders are making psychological mistakes and don’t even realize it.

Forex Trading Psychology Babypips Com

The psychology of forex trading i have been a trader long enough to know a thing or two about how most forex psychology trading people think while trading the market. you see, most people experience similar thinking patterns and emotions as they trade the markets, and we can learn many important things from the differences in the way losing traders think and the way winning traders think. Alexander elder trading strategy the triple screen. by last updated may 28, 2020 all strategies, forex basics, forex strategies, indicator strategies, trading psychology. the alexander elder trading strategy is also known as the triple screen trading system combines oscillators with trend-following tools in order to refine the performance of both. Trading the forex markets takes hard work, discipline, a plan and the right personality to be profitable. you will be tested consistently and this will requ. Trading psychology is a broad term that includes all the emotions and feelings that a typical trader will encounter when trading. get clarity on forex trading truths and lies from our analysts.

Trading Psychology Trading Strategy Guides

Forex slippage control if you’ve only recently joined the ranks of live traders, the term order slippage might sound foreign. for beginner traders who are only used to demo trading or theoretical trading from their studies, slippage is a nonexistent phenomenon. Learn trading forex. how to understand crb index (part 1) how to understand crb index (part 2) trading psychology (part 1) trading psychology (part 2) trading psychology (part forex psychology trading 3) trading psychology (part 4) knowledge of forex trading. support and resistance; trendline and its application; two methods to approach financial markets; forex versus. 14 videos play all forex trading psychology no nonsense forex forex risk -a structure you can follow right now duration: 31:31. no nonsense forex 257,620 views. Tradingpsychology is a key aspect to the success of the forex market. this addresses a trader’s emotional situation when entering and exiting market trades, looks for potential trades possibilities or conducts other market-related tasks.

The Psychology Of Forex Trading Learn To Trade The Market

It is the skill of managing your own emotions and is a part of forex trading psychology. victor sperandeo, a founding partner of eam partners, l. p and popularly known as ‘trader vic’ says “the key to trading success is emotional discipline. if intelligence were the key, there would be a lot more people making money trading. ”. It's interesting to examine forex trading psychology and its effect on the profits or losses of a trader. these factors include greed, fear, euphoria & panic. 5 common trading psychology mistakes forex newbies make 15 days ago by dr. pipslow before you open a live forex forex psychology trading account, it is important that you familiarize yourself with the most common trading psychology mistakes newbies make. Even classic books can maintain their relevance over several generations. first published in 1923, this book by edwin lefevre is based on legendary trader jesse livermore. combining rich storytelling with a deep insight into what it takes to trade successfully (and actions that can ruin a trader), the material can be read over and over again, offering new or different insights each time as you.

6 Powerful Trading Psychology Quotes From Mark Douglas

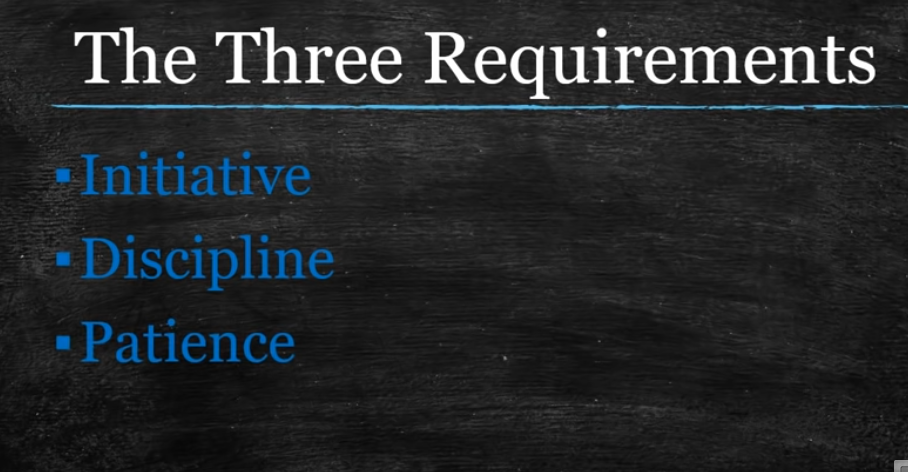

In the essence of trading psychology in one skill, i share the shift in perspective i underwent that has helped me let go of my bad habits and generate consistency in my behavior and my results. this short book is a culmination of everything i have learned while changing my life, and now, i want to help you change yours!. Psychology in forex is a significant subject that must be learned and understood by those looking at long-term trading market success. emotional control and self-mastery are important if trading has to achieve consistency. fear is a powerful threat to decision making which should drive our choices in trading. See more videos for trading forex psychology. Forextradingpsychology tips. it is easy to read about and acknowledge all of this but some of it is unavoidable. maintaining the discipline and patience to develop your complete trading plan, then build confidence in it, are the easier parts because they can be taught. dealing with the emotional effects of trading with real money will be a.

Controlling one's emotions is vital for every forex trader. here you will find the free e-books about forex trading psychology and emotion control in the financial trading. you will learn how to calm yourself and set the long-term goals in your trading. recommended for all traders. almost all forex e-books are in. pdf format. Forex trading psychology is a forex psychology trading big thing. often, it is the psychology, and not a lack of academic knowledge or skill in application, that is considered to be the primary originator of trading mistakes. mistakes are constantly repeated by financial traders of various national, cultural, and social.

Belum ada Komentar untuk "Forex Psychology Trading"

Posting Komentar