400 Leverage Forex Trading 1

Top Forex Brokers With High Leverage 4001 5001 10001

Top Forex Brokers With High Leverage 4001 5001 10001

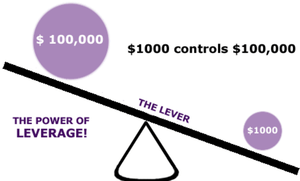

Trading currencies on margin lets you increase your buying power. here's a simplified example: if you have $2,000 cash in a margin account that allows 400:1 leverage*, you could purchase up to $800,000 worth of currency-because you only have to post 0. 25% of the purchase price as collateral. In the past, many brokers had the ability to offer significant leverage ratios as high as 400:1. this means, that with only a $250 deposit, a trader could control roughly $100,000 in currency on.

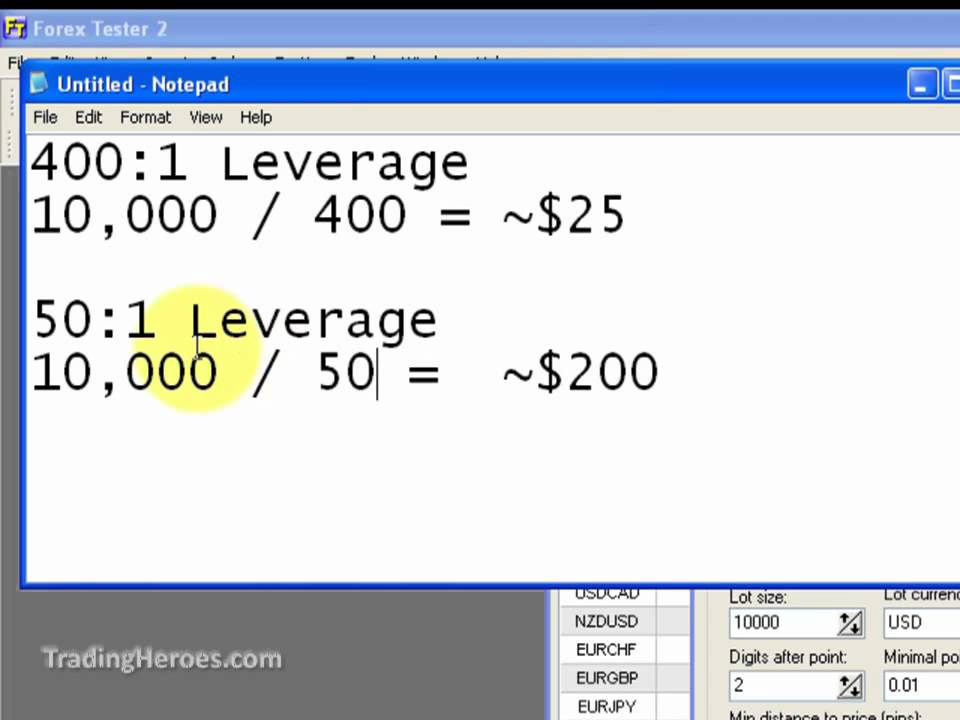

The leverage doesn't make any difference if i 'm only trading one lot, other than i would get a margin call at £50(per lot) with 200:1 leverage but at 50:1 leverage the margin call would be at £200 (per lot)also, i can earn interest at 50;1 leverage, but not at any higher leverages. For example, most forex brokers say they require 2%, 1%,. 5% or. 25% margin. based on the margin required by your broker, you can calculate the maximum leverage you can wield with your trading account. if your broker requires 400 leverage forex trading 1 a 2% margin, you have a leverage of 50:1. here are the other popular leverage “flavors” most brokers offer:. Standard trading is done on 100,000 units of currency, so for a trade of this size, the leverage provided is usually 50:1 or 100:1. leverage of 200:1 is usually used for positions of $50,000 or less.

Forexleverage And Margin Explained Babypips Com

Top forex brokers with high leverage 400:1, 500:1, 1000:1.

Typical leverage amounts 400 leverage forex trading 1 range from 50:1 to as high as 400:1, depending on the particular broker and how large the position is that the investor is trading. normal trading is done based on 100,000 units of currency, the leverage usually provided for this size trade would likely be 50:1 or 100:1. leverage of 200:1 is commonly used for $50,000 or.

How Much Leverage Is Right For You In Forex Trades

Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. in the case of 50:1 leverage (or 2% margin required), for example, $1 in a trading account can control a position worth $50. as a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential. Forexbrokers offering 500:1 leverage one of the reasons why so many people are attracted to the forex market is that you can usually get much higher leverage than you would with stocks for example. and leverage as high as 1:500 is provided by a number of forex brokers, including some reliable and well-regulated ones.

Forexbrokers Offering 5001 Leverage

Are you starting to see why leverage is the top killer of forex traders? as a new trader, you should consider limiting your leverage to a maximum of 10:1. or to be really 400 leverage forex trading 1 safe, 1:1. trading with too high a leverage ratio is one of the most common errors made by new forex traders. Leverage 1:200 forex brokersleverage is a concept in online trading and is used both by brokerage companies and investors. investors typically use leverage to increase their trading capital way beyond their available balance, which enables them to significantly boost their returns from successful trades.

Take your trading to the next level with europe's most exciting broker. 100s of commission free assets, 1:400 leverage, 24-hour support and more! trade now!. List of top forex brokers with highest leverage 100:1, 200:1, 400:1, 500:1 and 1000:1 in 2020. here is our recommended for beginners and professional traders.

Forex brokers offering 500:1 leverage.

Someone speaking of 400 leverage forex trading 1 a trade with “1:400 leverage” is saying they’ve posted $1 for each $400 in risk/reward. 1:400 leverage is very high and typically only found in the retail spot forex markets client could purchase (or sell) $40,000 with as littl. 400:1: four-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth $400. some brokers offer 400:1 on mini lot accounts but beware of any broker who offers this type of leverage for a small account. anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be. 400:1: four-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth $400. some brokers offer 400:1 on mini lot accounts but beware of any broker who offers this type of leverage for a small account. anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be.

1:300 leverage means you are either a hero or a zero. Leverage determines the amount traders move on the actual market. for instance, on a trading account having a leverage of 400:1, traders move on the real market 400 times more than the actual position in their retail account. how does leverage work? imagine you open a trading account with a broker, and the leverage is 200:1. and, you deposit $1000. Hello i’m a complete forex noob and i don’t plan to trade live within the next few months. i’m currently using a fxcm micro demo account with 5000 usd and 400:1 leverage. since there software is really fine in my opinion and i only have 1000 usd to invest in real money i think i’m going to give them a chance when im ready for trading real money. but here comes my question: i’ve read.

What the best leverage to use when trading with a $500 forex account? the usual leverage used by professional forex traders is 100:1. what this means is that with $500 in your account you can control $50k. 100:1 is the best leverage that you should use. See 400 leverage forex trading 1 more videos for forex trading 400 1 leverage. trading fx with more than 40 currency pairs forex trading benefits institutional spreads from 0 points metatrader4, metatrader5, ctrader, r trader platforms leverage: up to 1:2000 fastest execution possible read more stocks access to over 9,400 us, german and swiss stocks via r trader Forex brokers offering 500:1 leverage one of the reasons why so many people are attracted to the forex market is that you can usually get much higher leverage than you would with stocks for example. and leverage as high as 1:500 is provided by a number of forex brokers, including some reliable and well-regulated ones.

Belum ada Komentar untuk "400 Leverage Forex Trading 1"

Posting Komentar