In What Is Leverage Forex

Forex Margin And Leverage Forex Com

Margin Leverage Faqs Margin Requirements Forex Com

What Is Leverage In Forex We Explain Sa Shares

Margin & leverage faqs margin requirements forex. com.

Leverage or margin loan is the maximum you can pay your forex broker on your capital. suppose your balance or capital is $ 100. if you use 1:200 leverage. What is a good leverage ratio for forex? good leverage for forex trading is equal or above 1:100 such as 1:100, 1:200, 1:500, 1:1000. for professional traders, the bigger leverage is better. this statement is tricky because a lot of financial theorists present the opinion that lower leverage means bigger profitability.

Forex trading involves significant risk of loss and is not suitable for all investors. full disclosure. spot gold and silver contracts are not subject to regulation under the u. s. commodity exchange act. *increasing leverage increases risk. gain capital group llc (dba forex. com) 135 us hwy 202/206 bedminster nj 07921, usa. The leverage that is achievable in the forex market is one of the highest that investors can obtain. with leverage forex traders have more trading opportunities in the market than what they are required to pay for. thus, the main advantage of leverage in forex is that a trader can make reasonable to significant profits with only a limited. Forex leverage for beginners. when first in demo use whatever you want somewhere around 1:200+ so you in what is leverage forex can get your vot in. once you settle down a bit and get more comfortable dial it down a bit and look at things as risk %. Margin and leverage are among the most important concepts to understand when trading forex. these essential tools allow forex traders to control trading positions that are substantially greater in size than would be the case without the use of these tools. at the most fundamental level, margin is the amount of money in a trader's account that is required as a deposit in order to open and.

8 What Is Leverage In Forex Tradingwithrayner

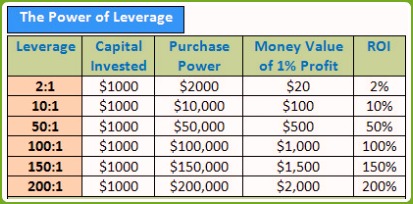

Leverage is the ability to use something small to control something big. specific to foreign exchange (forex or fx) trading, it means you can have a small amount of capital in your account, controlling a larger amount in the market. Are you starting to see why leverage is the top killer of forex traders? as a new trader, you should consider limiting your leverage to a maximum of 10:1. or to be really safe, 1:1. trading with too high a leverage ratio is one of the most common errors made by new forex traders. What is leverage in forex trading? traders in forex trade a contract of currency exchange rates. as the movement of currency rates can be very small, traders use leverage to increase their profit. What is leverage in forex. leverage in forex means you’re borrowing money from your broker to trade a larger position. for example: let’s say your account has $1,000 capital. if the leverage is 10:1, you can open a position size of $10,000. if the leverage in what is leverage forex is 100:1, you can open a position size of $100,000.

Best leverage forex trading depends on the capital owned by the traders, and it is said that 1:100 to 1:200 is the forex leverage best. it simply means that with $500 in the account of a trader, he/she can control $50,000. so, 100:1 is the best leverage to be used in forex trading. more than fiat currency, as they give the leverage to the users to have them in cryptocurrency as well as convert into fiat currency including the appreciation that is the profit earned over the coins posted on august 23, 2018 january 14, 2019 categories general brokersthe guiding lights for investors trading in forex is an immeasurably risky game everyone should extremely See more videos for what is leverage in forex. Leverage gives the trader the ability to make huge profits, and in what is leverage forex at the same time keep risk capital to a minimum. traders must remember that in forex, leverage is a double-edged sword: while it can multiply your gain potential exponentially, it can equally magnify your loss potential. abuse it and you might find yourself broke in no time.

How leverage works in the forex market investopedia.

Using leverage in forex. in forex, investors use leverage to in what is leverage forex profit from the fluctuations in exchange rates between two different countries. the leverage that is achievable in the forex market is. Forexleverage for beginners. when first in demo use whatever you want somewhere around 1:200+ so you can get your vot in. once you settle down a bit and get more comfortable dial it down a bit and look at things as risk %.

Using leverage is a widespread phenomenon in the forex community because the currency markets generally offer some of the highest leverage ratios investors can hope for. currency traders can sometimes benefit from leverages as high as 200:1 or even 500:1 for major forex pairs like gbp/usd, eur/usd, and gbp/eur. Leverage trading in over 10,000+ assets, including forex, metals, indices, commodities and more; advanced charting tools and indicators on the most popular trading platforms to monitor price action we do not recommend unnecessarily high leverage on risky assets. What is leverage in forex trading? if you are a rookie trader, you may also ask questions such as 'what is leverage in forex in what is leverage forex trading? ' 'how can it be useful? ' this article provides answers to these types of questions and a detailed overview of using forex, a list of pros and cons, possible applications and limitations.

There is a relationship between leverage and its impact on your forex trading account. the greater the amount of effective leverage used, the greater the swings (up and down) in your account equity. For example, most forex brokers say they require 2%, 1%,. 5% or. 25% margin. based on the margin required by your broker, you can calculate the maximum leverage you can wield with your trading account. if your broker requires a 2% margin, you have a leverage of 50:1. here are the other popular leverage “flavors” most brokers offer:. Selecting the right forex leverage level depends on a trader’s experience, risk tolerance and comfort when operating in the global currency markets. new traders should familiarize themselves. So, forex leverage can be used successfully and profitably with proper management. keep in mind that the leverage is totally flexible and customizable to each trader's needs and choices. now having a better understanding of forex leverage, find out how trading leverage works with an example.

Belum ada Komentar untuk "In What Is Leverage Forex"

Posting Komentar